Plans change. Your savings should, too.

As kids grow up, their dreams can change. The child who wanted to be a veterinarian at age five, may end up in trade school later on. Either way, her MOST 529 account will be there, because it covers a lot more than tuition at a lot more places than just colleges.

A MOST 529 account can help with:

- Tuition, room & board, books, fees, computers, and more at eligible 2- and 4-year public and private colleges and universities worldwide

- Eligible trade and vocational school and worldwide apprenticeship programs that are registered and certified with the U.S. Secretary of Labor1

- Graduate school worldwide

- Student loan repayment2

- Continuing education and career retraining

- K-12 public, private, and religious institutions expenses3

- Qualified postsecondary credentialing expenses4

- Recognized postsecondary credential programs5

- Rollover your 529 savings into a Roth IRA if they are no longer needed for education5

Things happen along the way.

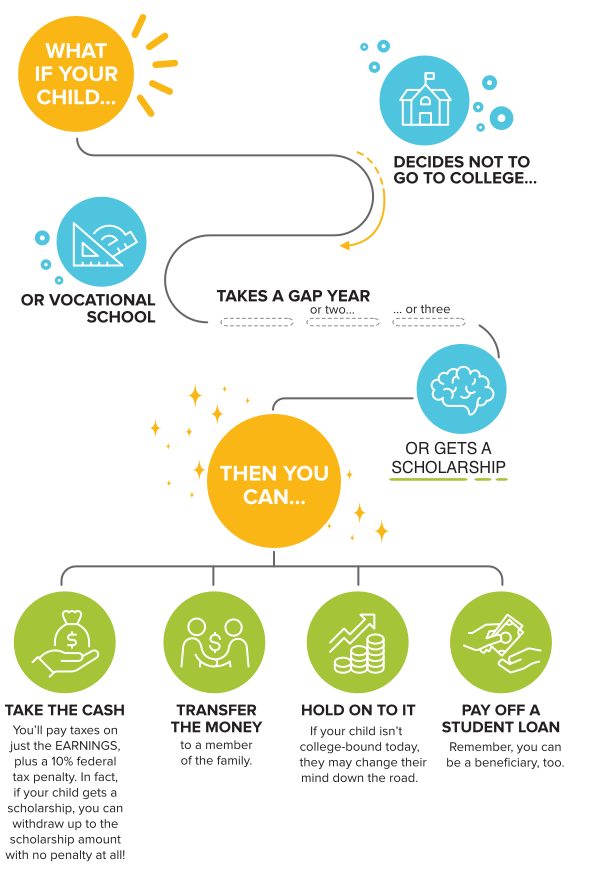

What if your child:

Decides not to attend college or vocational school? Gets a scholarship and doesn’t need the money? Opts to take a gap year or two (or three)? Then you can:

- Take the cash. You’ll pay taxes on just the EARNINGS, plus a 10% federal tax penalty. In fact, if your child gets a scholarship, you can withdraw up to the scholarship amount with no penalty at all!

- Transfer the money to a member of the family.

- Hold on to it. If your child isn’t college-bound today, they may change their mind down the road.

- Pay off a student loan2. Remember, you can be a beneficiary, too.